New Distribution Capabilities,

and American Airlines

Travel distribution continues to evolve as does our business travel industry as a whole. Travel Incorporated embraces change and maintains our position not only as thought leaders, but as leaders ahead of the technology and innovation trends.

Recently there has been a great deal of discussion relating to American Airlines and their upcoming shifts in their content distribution model, which is referred to as Modern Retailing. Travel Incorporated is pleased to take this opportunity to bring not only the facts, but our position and recommendations, as we work together to adjust and service these shifts in content distribution through the New Distribution Capability (NDC).

NDC is a new distribution platform designed to expand the current limitations of the Global Distribution System (GDS) mainframe architecture. It is designed to promote airline branding and provide rich content and amenities.

American Airlines has advised that effective April 1, 2023, they will be shifting a portion of their inventory over to the NDC channels and removing the designated content from traditional GDS mainframe technologies (EDIFACT). This is what is being referred to as Modern Retailing, providing alternatives for the airline to distribute and package their content dynamically. The NDC channels include a new GDS-enabled platform which is what Travel Incorporated will be utilizing to service and support our clients’ bookings.

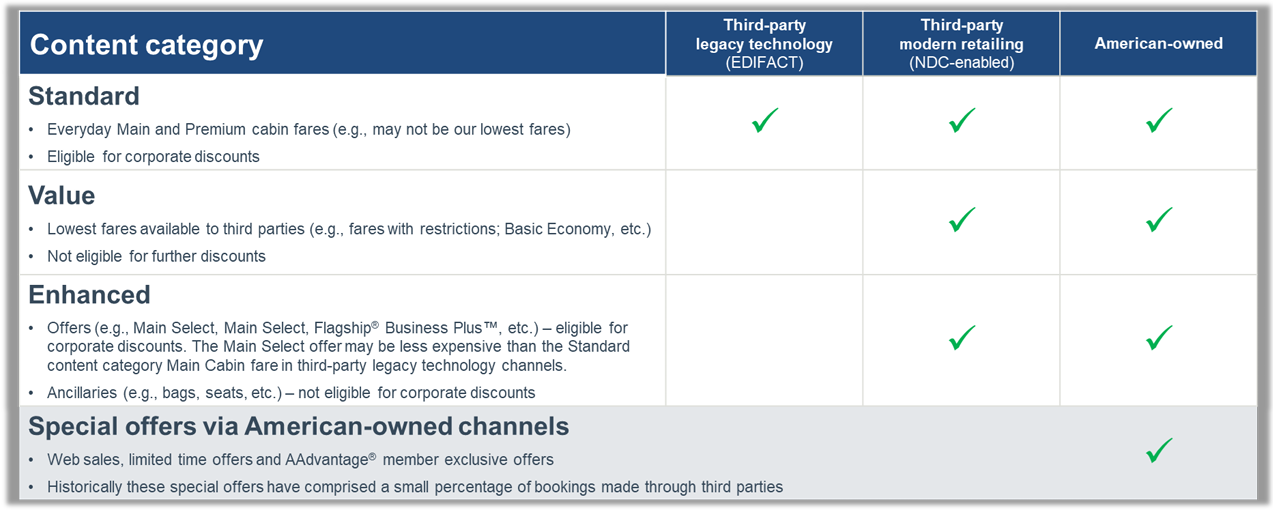

American Airlines has stated that approximately 40% of its current inventory will be shifting as part of their initiative. The initial shift will include the ‘Basic Economy’ scheduling and fares as well as single leg, short haul, low cost routes. In a recent guideline distributed by American Airlines, they categorized their content in four verticals: Standard, Value, Enhanced and Special offers.

As the initial shift of fares is predominantly focused on the leisure travel segmentation, as outlined in the Value category, the short-term impact to the business travel sector is expected to be minimal. What remains unclear, however, is the impact to the corporate negotiated fares within the new Enhanced category.

We can confirm that Travel Incorporated will have access via the GDS to all of American Airlines NDC content via the NDC-enabled GDS connectivity. However, SAP Concur has stated that the work required for their NDC schema version 21.3 ‘would be completed no sooner than this summer”. While there are options for connectivity through their Select Access program as well as integrating via TripLink, these methods will require additional servicing and reporting integration methods.

We affirm our commitment to innovation and service within the business travel industry and welcome new opportunities to provide our clients with the content distribution options available as technology continues to evolve. We are a strong partner with American Airlines and will continue to work together to ensure each of our clients are serviced and supported as they deserve.

During this time of uncertainty, we do suggest that any of our clients that hold preferred negotiated rates with American schedule time to ask the hard questions so that they are clear on the potential impact to their programs, both short and long-term. It is important that questions are answered thoroughly. Travel Incorporated is here and committed to your program’s success and will continue to provide updates to you on this topic as more detail becomes available.

We invite you to listen to our latest podcast, Your Window Seat, where we invited Cory Garner, CEO of T2RL Travel Research and previous AA Executive, to break down what Modern Retailing is, the technology requirements and commentary on the impact to business travel programs.

and American Airlines

Leave a Reply

Want to join the discussion?Feel free to contribute!