Mileage Reimbursements vs. Rental Car Calculations

(February 2022)

Corporate Travel Departments continue to review their travel policies to incorporate higher safety and health standards, approval parameters for air travel, and now are considering a shift to rental cars over personal vehicle mileage reimbursement.

Factors that are contributing to this review include the management of incorrect expense reimbursements, and the benefit to finding the right breakeven point for cost savings through corporate negotiated rates.

Mileage Fraud

According to a study released by Chrome River, travel expense fraud costs businesses $2.8 billion per year, and over-reported business mileage makes up to 34.5% of these fraudulent claims. Mileage fraud is the easiest type of fraud to commit, because it often goes unnoticed and is routinely the result of honest mistakes or effort to oversimplify reporting. The most common reasons for over reimbursement include:

- Rely on self-reported, non-validated mileage data

- Require guesstimates and/or burdensome processes to achieve accuracy

- Allow for individual policy interpretation around such issues as commute or personal miles

- Combining personal travel during business related tips

- Combination of the above

Focusing on self-reported mileage, the same Chrome River study found that, of those who commit mileage fraud, 76% use manual submission processes and are based on the ‘honor’ system. A further study conducted by KDS identified that approximately 1 in 5 business travelers exaggerate mileage by rounding to the nearest one, five or 10 miles. Although a simple rounding may only equate to a few dollars per instance, it can become millions of dollars over time if enough fleet drivers resort to this practice.

Finding the Right Balance for Cost Management

The IRS has increased the reimbursement amount for 2022 to 58.5 cents per mile, up 2.5 cents from 2021. This takes into consideration the average cost to operate a vehicle, national average of gas prices and automotive insurance.

When given the choice, most employees prefer to drive their own vehicles, largely due to the comfort and convenience, as well as view the reimbursements as additional revenue. In reality, this varies significantly based upon the age of the vehicle, if the vehicle is leased or paid off, and the gas mileage based upon local or highway traffic.

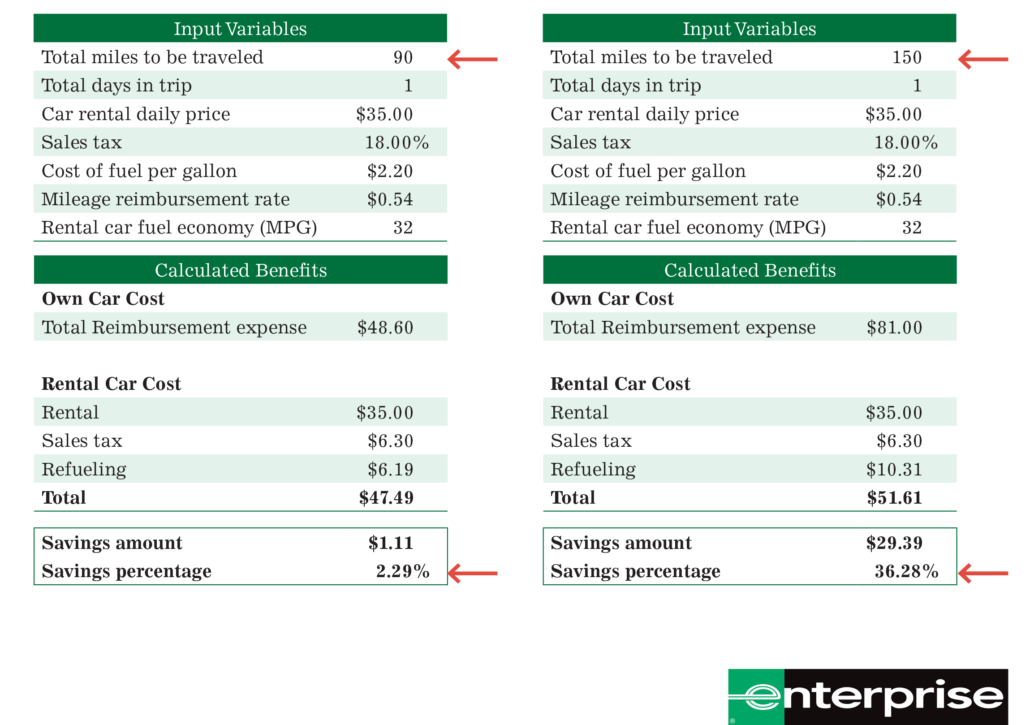

The Enterprise Group provides numerous case studies as well as a calculator which can be used to assist a corporate travel team in identifying the ‘breakeven point’ for their program. In this example, calculations were performed to identify the cost of mileage reimbursement vs rental car for distances of 90 miles per day and 150 miles per day.

It was identified that 90 miles was the breakeven point, and all trips over 90 miles would require a rental car.

Over the course of 5 years, this company moved 25% of their mileage reimbursement over to rental, averaging a 32% reduction in their overall mileage reimbursement expense, and further decreased their negotiating rates by adding more rental days to their preferred program.

To review for your own program, we suggest inquiring with your preferred suppliers about calculators available to determine the right savings for your company. For an immediate estimate which includes your loading your own negotiated rate as part of the parameters, the Enterprise Group provides a calculator on their website and can be accessed here.

Leave a Reply

Want to join the discussion?Feel free to contribute!