Return to Travel Planning – Hotel Negotiations

(September, 2020)

|

This 3rd segment in TI’s Return to Travel Planning series focuses on the Hotel Industry. There have been conflicting opinions in the press as to if, let alone when, the timing might be right to reengage with your global hotel partners. This article focuses on the state of the hotel industry, how we are seeing it rebound, and our recommendations as you consider your approach to preferred supplier negotiations.

|

|

Uncertainty with Future Hotel Programs

|

| The end of the 1st quarter shifted from an all-time high to the lowest rates since 2008 for the hotel industry worldwide. The combination of hotels that have had to temporarily close, dramatically invest in higher tech cleanliness standards, and experienced a dramatic fluctuation in rates has put the hotel industry in a whirlwind of uncertainty with both current and future hotel programs. To date, 84% of all hotel properties have either been forced to lay-off or furlough employees with only 37% having brought any back to the workforce.

The GBTA (Global Business Travel Association) made a very early recommendation on April 29th suggesting postponing all hotel RFPs until 2021, basing this on a ‘commonsense approach’ to the impact of the pandemic. This rare recommendation, albeit sensitive to the deep employee lay-offs and furloughs, brought about significant pushback from industry experts and critics commenting that procurement professionals who fail to use this time to reevaluate their processes are eroding the value of corporate travel programs.

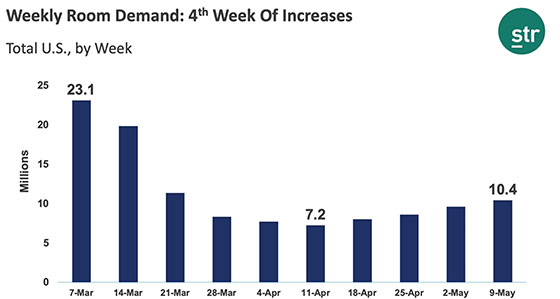

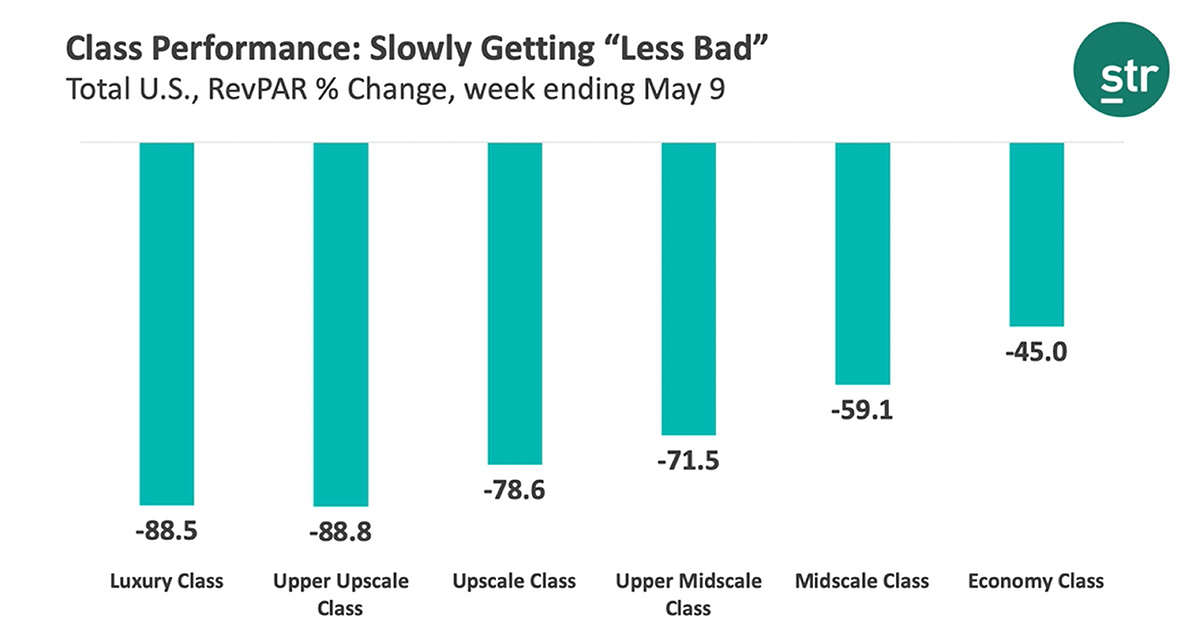

According to Smith Travel Research (STR), the past four weeks demonstrated steady increase of room demand indicating the gradual confidence in the return to travel. Although the progressive increase is encouraging, the occupancy level is still near 30% in the U.S.  One key metric watched by industry experts is the loss of RevPAR (Revenue Per Available Room). While the holistic percentage is down 74.4% year-over-year, it is interesting to note the primary increase in occupancy is with the midscale and economy classes for hotels.

Travel Incorporated continues to have ongoing conversations with our hotel supplier partners, clients and the industry as a whole. Although no one has a crystal ball, recent industry webinars suggest that the vast majority of experts are anticipating rates of transient/business travel to either stay flat or slightly decrease. The exceptions are in key markets such as New York and Las Vegas. This is in stark comparison to the average year-over-year increase in rates by as much as 3%. As a result of these discussions, we do not suggest rolling over your programs holistically, but rather recommend taking a multi-layered approach as follows: Have a solid projection of your anticipated volume. Every company is experiencing a time of uncertainty, and it may seem a bit far-fetched to expect a solid plan at this time. However, before contemplating any negotiations, it is important to have a fact-based projection of your expected spend. You should base your estimates upon your historic data, the expected shift by both percentage of travel likely to occur and the anticipation of travel from your routine travelers over the next 18 months, including specific client and office locations that you expect to continually visit. Negotiate a combination of static and dynamic rates. If your current preferred programs include deep, dynamic discounted rates, it makes perfect commercial sense to extend those specific contracts through 2021 without penalty. Your suppliers will benefit from the ongoing partnership of your business and not risk losing the likelihood of the future growth. However, for the remainder of your fixed rates, we suggest negotiating a mix of dynamic and static rates based upon your objectives and tolerance for risk. Impacts of this are as follows:

For those companies with more uncertainty than estimates. We have many clients who are presently taking the position of caution and will continue to do so. Remember that during this time, if you are limiting your travel, you will continue to save through our proprietary HotelRate Check re-shopping platform. Over the past few months we were able to save those clients who were traveling over three times the amount of rate reductions over the same period last year! Health, Cleanliness and Amenities. When pursuing your discussions and negotiations, ensure your preferred hotels have a consistent set of health and cleanliness procedures, as well as overall standards in place. Most chains have invested heavily in new cleaning technology and directives, and it is important that you build into your program a commitment to these guidelines. TI has added a new aggregate listing on our Covid-19 Information Hub of the cleanliness standards and policies for many regional and global hotel brands. Lastly, consider that the value of amenities could be limited with restaurants at full-service hotels being closed. |

|

Summary

|

|

Keep in mind that data will continue to drive successful hotel negotiations. Now is the time to engage with your preferred suppliers and commence discussions based upon your early estimates and historic booking levels. Consider shifting your fixed rate programs to dynamic discounts, and remember this process may be more difficult or lengthy than usual due to furloughs and closures currently in place at many hotels. As always, your TI Client Success Manager is here to help guide you through these decisions.

|

Leave a Reply

Want to join the discussion?Feel free to contribute!